Dive Brief:

-

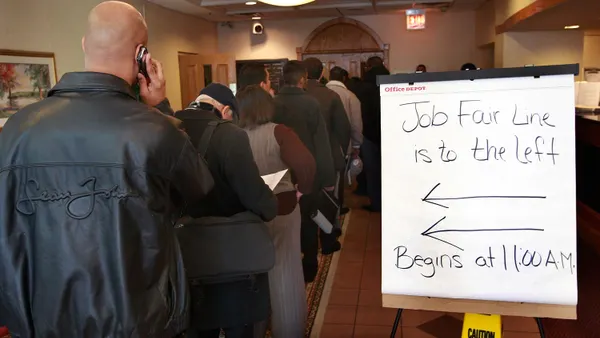

Both employers and retirement age workers are taking advantage of a growing trend towards extended retirements, according to CNBC.

-

By 2024, one in four U.S. workers will likely be 55 or older, according to the Bureau of Labor Statistics, and the older worker growth rate in the labor force is more than three times that of all workers, CNBC reports. In short, an aging workforce means employers and employees both will have to be more flexible.

-

This new "fluid approach to retirement," called phased retirement, means retirement age employees are either staying on with their current employers or going back to work in another or the same profession. Employers who take advantage of the trend can create a win-win strategy that helps employers solve some of their talent challenges.

Dive Insight

According to CNBC, both public and private sector employers are taking advantage. For example, the U.S. Department of Defense recently announced civilian employees could partially retire while remaining on the job part-time. Right now, around 77,000 federal workers are eligible for the program, according to a Defense Department spokesman.

In the private sector, informal arrangements are the rule, as only about 6% of large employers have formal phased retirement policies, according to Aon Hewitt, which also found that 42% of employers are thinking about a more formal approach. 30% of large employers (1,000 employees or more) offer workers some flexible retirement option, according to research from WorldatWork.

Roselyn Feinsod, senior partner at Aon Hewitt, said the formal program data is often highly correlated with a specific industry, noting that such programs are prevalent in sectors such as health care, where the stress to retain nurses and other medical professionals is very high. Clearly, this trend has almost nothing but upside for employers willing to take advantage. They get to keep experienced, knowledgeable workers in the fold, which has many advantages over the alternative.