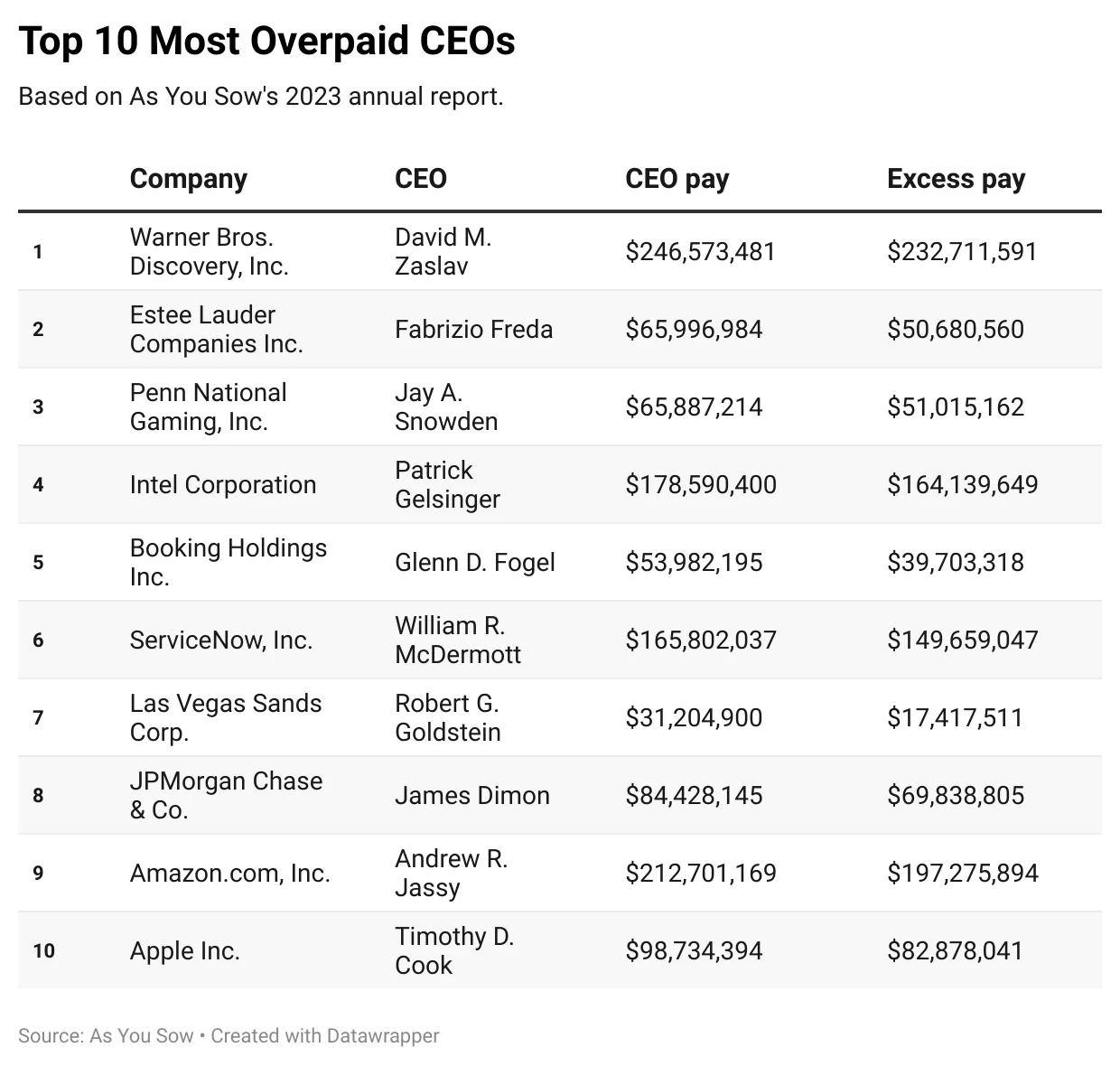

Shareholder advocacy group As You Sow released its ninth annual report Feb. 16, compiling a list of who it concluded are the S&P 500’s most overpaid CEOs.

CEO pay is on the rise overall, the organization noted, with the average pay of S&P 500 CEOs up 20.9% over the previous year. For the top 100 on the list, the average pay was 30.6% higher than the previous year.

As You Sow used three criteria to establish which CEOs were the most overpaid. First, it used an analysis of “excess pay,” as determined by total shareholder return (total stock gains or losses, plus reinvested dividends) compared with the amount the executive would be expected to earn given the company’s higher or lower financial performance. Next, the group identified the companies which had the highest percentage of shares voting against the CEO’s pay package. Finally, As You Sow compared the pay of the CEO to the median employee.

With the three criteria laid out, the group weighted the first two elements at 40% each and the last one at 20%, creating a single ranking.

While many of the companies have appeared near the top of the list in previous years, a few — including Amazon and Apple — appear in the Top 25 for the first time, As You Sow said.

As You Sow advocates for shareholders to use their power to address social and environmental problems through corporate action. In the case of CEOs the group has determined to be overpaid, As You Sow recommended shareholders vote against excessive pay packages.

“Every year we see more shareholders get serious about voting against compensation,” Rosanna Landis Weaver, executive compensation program manager and author of As You Sow’s report, said in a statement.

The report also drew attention to shareholder votes that resulted in a reduced pay package for CEOs who were underperforming. Activision Blizzard, for example, dropped CEO Robert Kotick’s pay from $154 million to under $1 million after nearly half of shareholders voted against his pay package. Similarly, Chipotle reduced its CEO’s pay from $38.3 million to $17.8 million after a shareholder vote.

Each year, As You Sow said, more shareholders join the move to vote against CEO pay packages. “In our last report, 16 of the S&P 500 companies had more than 50% of their shareholders vote against the CEO pay package,” the report noted. “This year there was a 25% increase in that figure, as 21 companies saw at least 50% of their shares reject the pay package of the CEO.”

U.S.-based financial managers remain less likely to vote against CEO pay packages, As You Sow found. BlackRock, the largest of these, voted against only 5.7% of S&P 500 CEO pay packages in 2022, and Vanguard, the next largest, voted against only 4.8%.

“This year, unfortunately, shareholder concern with excess pay is not truly reflected in the higher votes against pay, because the largest mutual funds continue to support the vast majority of overpaid CEOs,” Weaver said. “In this year’s report, we show that the votes do cause companies to respond when shareholders vote against excess, which only underlines our point.”