The technology industry is coming off a strong jobs report in February, marking two consecutive months of employment growth and a net jobs gain of 33,500 positions in the tech sector since the start of 2020.

The IT unemployment rate was 2.4% last month, a slight increase from 2.3% last year, according to IT trade association CompTIA, highlighting data from the U.S. Bureau of Labor Statistics.

2020 marks the best start to a year in tech sector jobs since 2017, CompTIA said. But businesses are contending with a wave of uncertainty which could stagnate hiring.

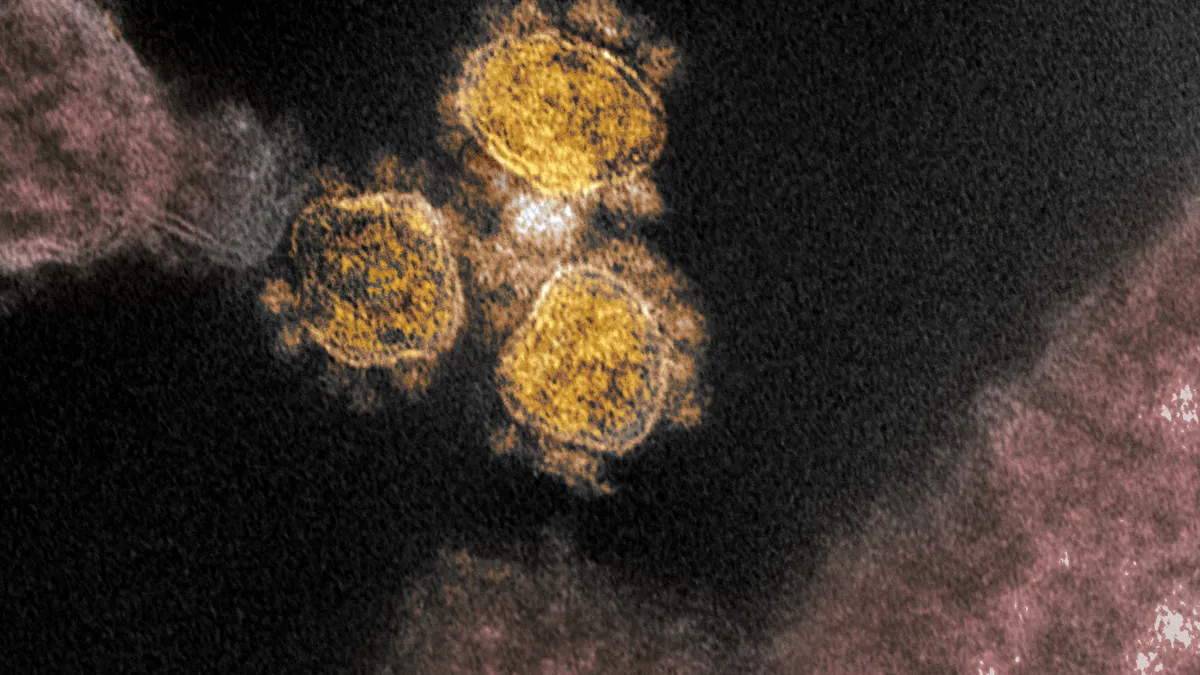

As the effects of the novel coronavirus and the COVID-19 illness are felt worldwide, experts are raising alarms about a potential recession and, with that, a dip in hiring.

"At this point, we can say with certainty that many industries have taken a financial hit due to the coronavirus," Tim Herbert, executive vice president for research and market intelligence at CompTIA, told HR Dive sister publication CIO Dive in an email. "What is unknown is the degree to which lost revenue is postponed, shifted to other expenditures, or permanently displaced."

The outbreak has rippling impacts, but the length and severity are unclear and differ across sectors.

Frontline workers rely on interpersonal contact and, as the virus spreads, businesses could experience a reduction in service demand. United Airlines is among carriers reducing capacity in response to demand, removing 10% of domestic and 20% of international schedules in April, the company said in SEC filings Tuesday. The company's CEO and president are foregoing their base salaries through the end of June.

Any hits to the overall economy could also impact technology. A recessionary impact could take two shapes, Herbert said:

-

A V-shape, where a short-lived dip is followed by a quick rebound.

-

Or a U-shape, where a decline will have a slow recovery period.

All directly affected industries — including travel, hospitality, restaurants and insurance — buy technology, according to Herbert. Technology vendors and service providers could see a sales decline in the short-term.

"It's too early to tell if these intended purchases among U.S. and overseas customers will be postponed to later in the year, or shifted to other areas, such as upgrades to technologies that facilitate remote work or enhance disaster recovery effectiveness," Herbert said.

Recessions, a rule of thumb

If a recession occurs, it will impact some industries more than others, though tech is particularly well positioned.

With an uptick in demand for remote work, which heavily relies on IT infrastructure and expertise, IT experts could find themselves heavily burdened by work as more companies become remote, said Josh Bivens, research director at the Economic Policy Institute, a left-leaning think tank.

"As a general rule, yes, I think recessions economy-wide definitely cause a steep reduction in hiring, lots of layoffs [and] you see the rise in unemployment," Bivens told CIO Dive. "There's usually pretty broad-based pain," but the epicenter of a potential coronavirus-induced recession would hit low-wage sectors and places where people gather, such as restaurants, tourism and entertainment.

The most recent example of a significant recession was the financial crisis of 2008. In 2009, employment in the tech industry fell 4.7% and tech occupation employment fell 2.1%, according to CompTIA data. Because the recession was deep it impacted every sector, though tech fared "reasonably well," according to Herbert.

One caution about comparing the market dip to the 2008 financial crisis is there were some advanced economic indicators. Coming off an "excellent jobs report" last week, "this one is going to kind of drop like a brick from the sky," Bivens said.

With the market struggling in the last week, indicators are pointing to a potential downturn in hiring. Data gathered by CompTIA from Burning Glass Insights offers a relatively real-time look at job postings for IT occupations in the U.S. The week of March 1-8 saw 57,103 postings, a 16% drop from the 67,787 job postings the week prior.

"My guess is we've already seen an economic effect and it's just not in our data yet, because that comes with a month lag," Bivens said.

If the policy response isn't big it could cause a recession, he said. "If we get the policy right, I think we could have a couple of very slow quarters, hopefully followed by a pretty crisp bounceback" once an all clear is given on the outbreak.