The Republican sweep in November’s election promises to shake up the HR industry, but for the time being, employers can expect at least a measure of continuity in employee benefits, WTW consultants said in a Dec. 4 virtual event.

With respect to retirement benefits, for example, some of the provisions of the 2021 SECURE Act 2.0 will continue to be implemented following the release of regulatory guidance, said Beth Ashmore, North America retirement client experience leader at the firm. That includes provisions such as the law’s high-earner catch-up contribution requirements for Roth individual retirement accounts.

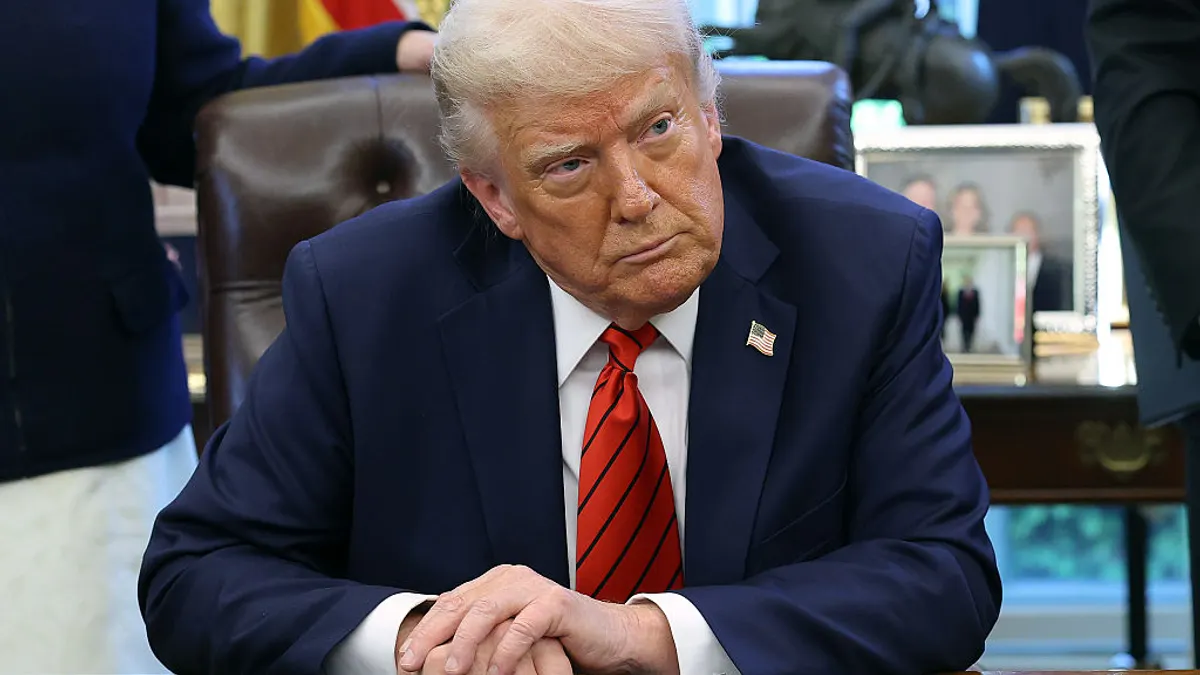

Aside from these points, however, Ashmore and her colleagues said that it remains to be seen how President-elect Donald Trump and his administration will tackle topics ranging from health insurance reform to retirement savings.

“We may see a bit of the implementation guidance be more sponsor-friendly with the change in the administration,” Ashmore said. Similarly, she said she did not expect the incoming Trump administration to allow the fiduciary rule and the environment, social and governance rule to proceed.

Capital and equity markets have welcomed the news that Trump is returning to the White House, said Jon Pliner, deputy chief investment officer at WTW. At the same time, some of the president-elect’s policy proposals could expand the federal budget deficit and thereby allow interest rate volatility to persist, he added.

“A stickier inflationary environment means that, in our perspective, it would be a good time to revisit the lineups that are offered to participants within 401(k) plans to ensure we’re providing them with the opportunity to gain real returns in excess of inflation over the long term,” Pliner said.

A change in healthcare priorities

Trump’s cabinet picks for healthcare agencies may signal a new approach toward health policy that is centered on safety, particularly with respect to vaccines and medical supplies, as well as increased transparency on these topics, said Courtney Stubblefield, North America health and benefits insights and commercialization leader at WTW.

“These could shape a lot of the national narrative around health,” Stubblefield said. “We could see a move toward more individual rights, fewer mandates, more flexibility [...] more deference to healthcare providers in decision making.”

There is also some speculation that Trump’s health team could shift the government’s focus from infectious disease to chronic disease, including prevention of chronic disease through methods such as holistic medicine. “There’s a lot to just watch and wait for,” Stubblefield said.

During his first administration, Trump backed an unsuccessful effort to repeal and replace the Affordable Care Act but ultimately did sign legislation repealing aspects of the law, including the “Cadillac tax” on high-cost, employer-sponsored health plans. So far, Trump has not indicated he will attempt to repeal the ACA but rather improve and optimize it, according to Stubblefield.

“That’s a very tall order,” Stubblefield said, but she speculated changes to the law could include changes to limits on the “rate bands” that insurers may set for health premiums as well as support for short-term medical plans.

On reproductive health, Trump has spoken out against implementing a nationwide abortion ban, but Stubblefield said employers may still want to pay attention to regulatory and congressional actions that could place limits on reproductive care. Trump has also backed mandatory insurance coverage of in-vitro fertilization.

Congressional lawmakers remain focused on addressing pharmaceutical benefit manager reform as well prescription drug costs, Stubblefield said. PBMs have attracted bipartisan scrutiny in recent months, but reform bills have so far been stalled. Those efforts may become more targeted to, for example, address the scope of pharmaceutical rebates or spread pricing, Stubblefield said, but employers will still have to wait for concrete details.

Pay plans in flux due to tariffs, regulatory shifts

Tax and tariff changes could have some effects on employer compensation plans that are already set to take effect for the year ahead, said Lori Wisper, global compensation strategy and design solution leader at WTW.

Another key focus is regulation under the Fair Labor Standards Act. The outgoing Biden administration attempted to expand overtime pay eligibility in an effort that was blocked by a federal judge last month. It has since appealed the decision. It is uncertain whether the Trump administration will abandon the appeal and maintain the 2019 eligibility regulations set during Trump’s first stint as president, Wisper said.

On pay transparency and minimum wage regulations, Wisper said she does not expect much movement at the federal level, despite Trump’s previous statements in favor of raising the minimum wage. States have nonetheless taken the lead in advancing both topics. Several state and local jurisdictions have enacted pay transparency laws. Meanwhile, Alaska and Missouri voters approved ballot initiatives on Election Day to increase their respective state minimum wages to $15 an hour.

Wisper said she has advised clients to take advantage of the “relative calm” in the present labor market to dig into making their compensation programs better. Employers could, for example, update their pay philosophies to ensure they are better prepared for trends such as pay transparency. They could also review their overtime exemptions to ensure FLSA compliance.

“This to me is the window of opportunity to get your house in order,” Wisper said. “All of those things will make you really ready for whatever is going to come down the pike.”