Dive Brief:

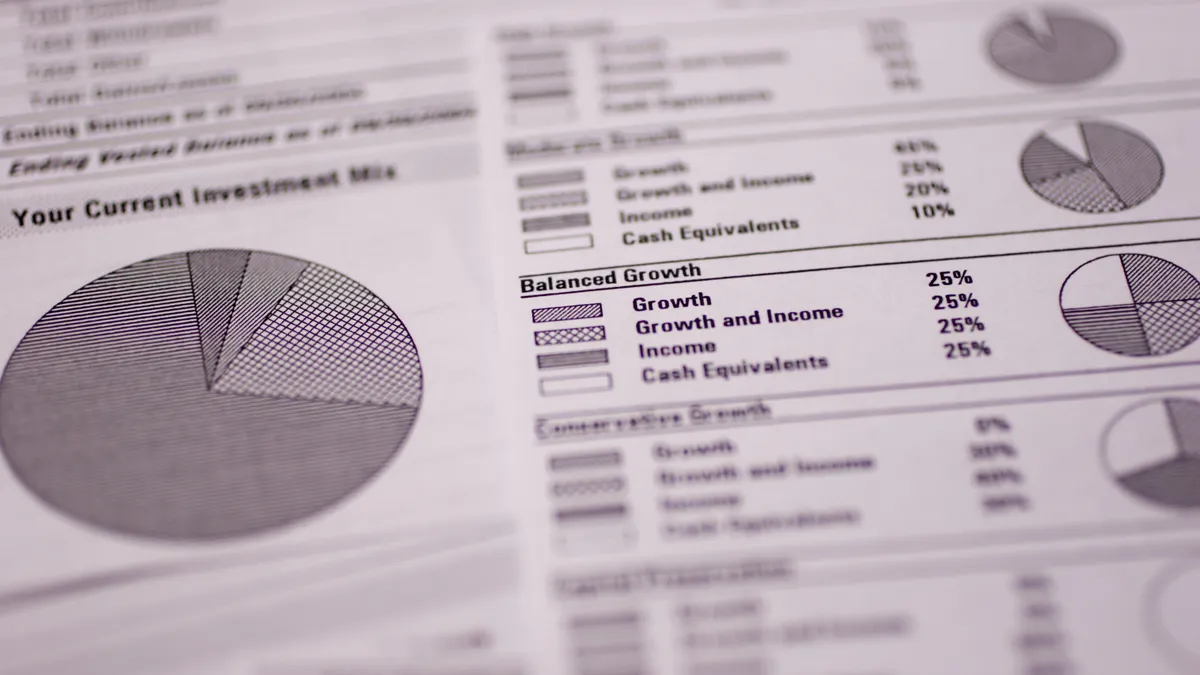

- Workers need more financial education, employees and employers agreed in a recent survey by online savings platform Vestwell. Nearly 9 in 10 employees said their employer should be involved in their retirement education, while employers who work with financial advisors likewise listed employee financial literacy and employee investment recommendations as the top issues they wished those advisors would address.

- Unsurprisingly, workers reported a high degree of economic strain. Three-quarters reported stress about their financial situation, 66% said their stress had increased due to inflation and market volatility and nearly half felt they should be saving more due to inflation. Those who had not contributed to their retirement plans in the past six months said a higher salary (40%) and a higher employer match (28%) would most likely motivate them to contribute.

- Workers also showed interest in alternative savings streams. Nearly 60% said they would consider adding a guaranteed lifetime income stream, such as a deferred annuity, although only 40% of employers were interested in offering such a benefit. “This suggests there is a potential opportunity for companies interested in exploring this option to highlight this as a differentiator in recruiting talent,” Vestment noted.

Dive Insight:

Again and again, reports have found that employees value financial education in the workplace — and want more of it.

Given the state of American financial education, it may not be surprising that workers are turning to their employers for support. According to a global financial literacy survey by Standard & Poor, only 57% of U.S. adults are considered financially literate, as defined by their knowledge of risk diversification, inflation, numeracy and compound interest. (This rate is higher in Northern Europe and lower across the developing world.)

Younger workers tend to be less financially literate and also tend to demonstrate weaker longevity knowledge, according to findings from the TIAA Institute and Global Financial Literacy Excellence Center. Given the focus on paying off student loans and other debt — and an apparently poor sense of time to save for retirement — losing focus on the importance of retirement savings may be a risk for such workers.

How can employers help with financial education? Start by analyzing how current benefits like retirement plans are used, one expert suggested. This can help employers understand which financial benefits are being underused. If employee assistance programs offer financial counseling, for example, better communication may help connect workers with those offerings that already exist and may be underused. Deeper tracking may also uncover which groups are getting left behind.

While employers may be strained by current economic conditions, they can still consider a broader approach to financial support for employees, taking into account aspects that they typically may not pay attention to, such as student loans. A student loan repayment benefit, for example, may not only free up savings for workers to drive into a retirement account, but may also help with recruiting and retention.