An analysis published in January by New York-based 401(k) plan consulting firm Abernathy Daley claimed that some 84% of U.S.-based retirement plans had at least one “red flag” signaling a potential violation of the Employee Retirement Income Security Act, but some in the industry have challenged the firm’s claims of widespread compliance risks.

Abernathy Daley said it analyzed Form 5500 filings — a mandatory reporting requirement for employers maintaining ERISA-covered benefit plans — for 764,729 plans in its database.

What is an ERISA ‘red flag’?

The firm sorted its “red flag” findings in one of two categories. Forty-three percent of plans were found to have “regulatory infraction red flags” that could result in civil legal penalties among other consequences, while 76% of plans were found to have “egregious plan mismanagement red flags,” which Abernathy Daley said may not necessarily result in fines but could nonetheless indicate “fiduciary failure” on the part of either plan administrators or plan sponsors.

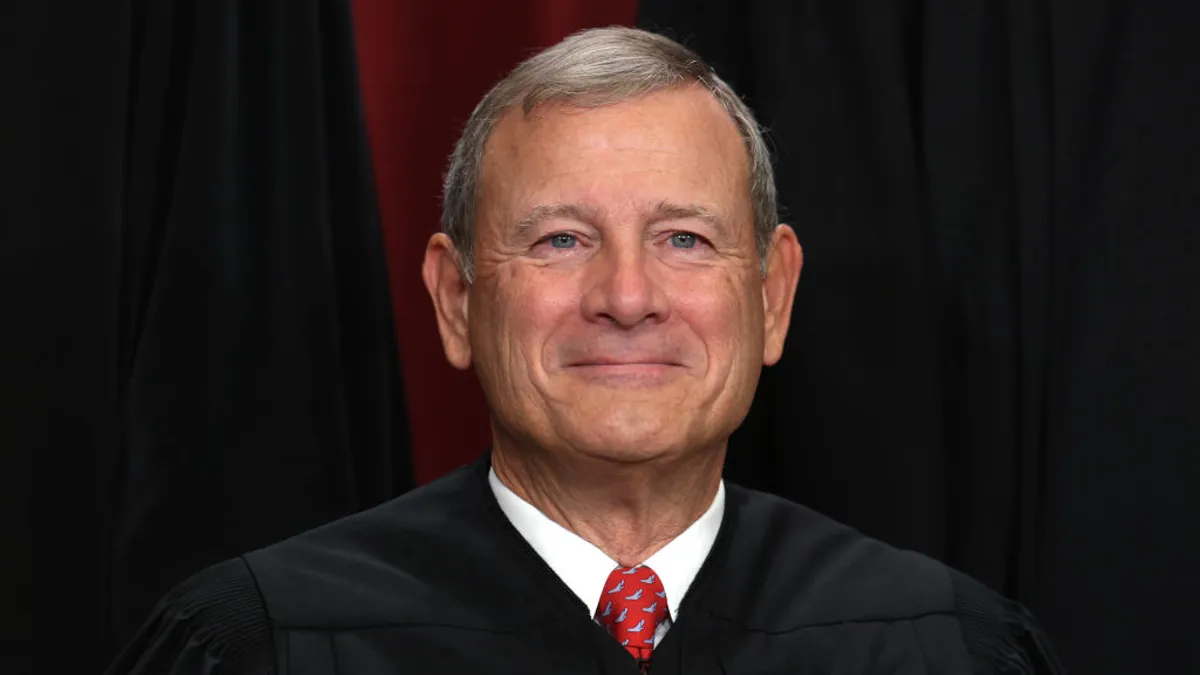

The firm identified four examples of each “red flag” category but did not provide a statistical breakdown of how many employers were found to have engaged in each individual practice. In an interview, Steven Abernathy, CEO of Abernathy Daley, said a lack of qualified default investment alternatives, or QDIAs, constituted the most commonly observed risk. QDIAs are a mechanism that allow plan sponsors to invest a participant’s assets in a default investment account if the participant has not specified where they would like to invest those assets.

Abernathy said the second and third most common observed risks, respectively, were a lack of automatic plan enrollment features and incomplete plan design. The firm only examined filings from companies with 100 or more employees, he added, because those companies have more resources and are more likely than smaller firms to be up to date with federal rules and regulations.

Employers can identify many of the deficiencies described in the report by having a qualified, independent third party benchmark their plans at least once per year, Abernathy said; “When you have a benchmark done, it shows you what is reasonable for the bookkeeping and administration, it shows you what your funds and performances should be, and it shows you where your plan is not constructed correctly.”

Retirement expert criticizes ‘scaremongering’

Abernathy Daley’s suggestion that the majority of retirement plans could be in danger of violating ERISA has not been received well by some.

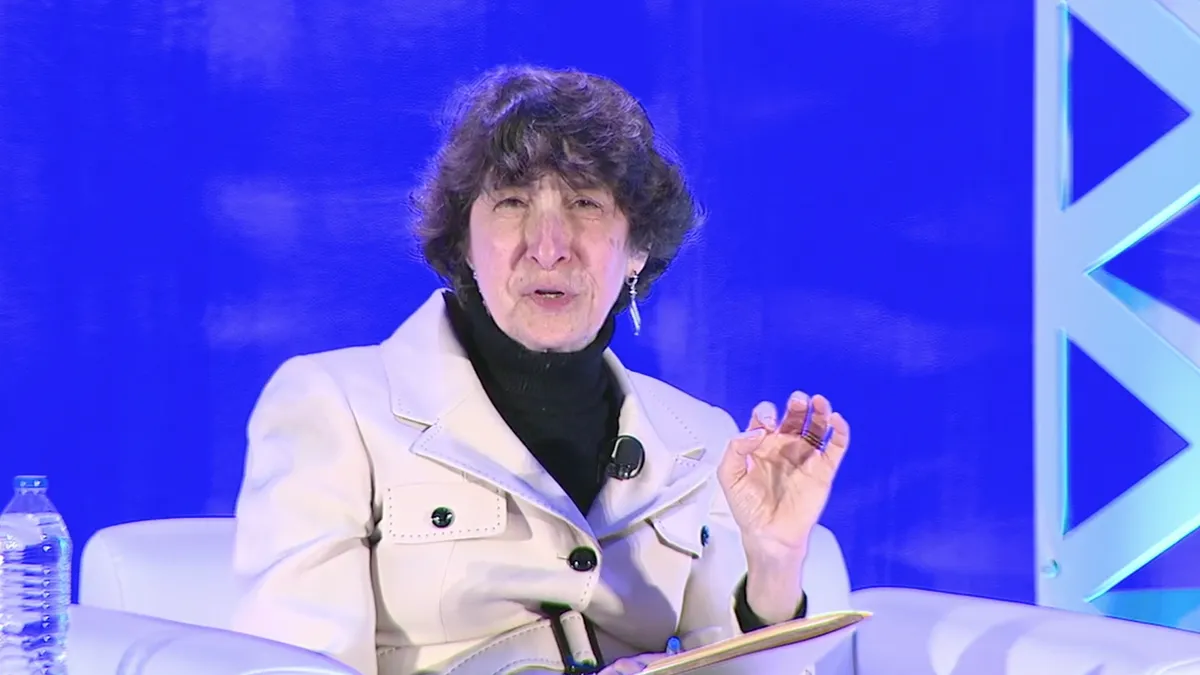

In a February article published by the American Society of Pension Professionals & Actuaries, Nevin Adams, former chief content officer and head of retirement research at the American Retirement Association, wrote that the firm’s descriptions of the practices it claimed to find were “arguably misleading” and that some of the practices would not actually violate ERISA.

Specifically, Adams said that there are no legal requirements for ERISA plans to offer a QDIA, provide automatic enrollment features or be compliant with Section 404(c) of ERISA, which states that fiduciaries of qualifying plans are not liable for any loss that results from a participant or beneficiary’s exercise of independent control over their assets.

Adams told HR Dive that Abernathy Daley’s report was “scaremongering” intended to drum up business, and he criticized the firm’s use of Form 5500s to conduct its research. The forms often reflect data that is multiple years old, he said, which means plan sponsors have likely had the opportunity to correct any errors or omissions.

“There’s no way in hell that 84% of plans are in trouble,” Adams said. “It’s just ludicrous on its face.”

While plan design elements such as QDIAs and automatic enrollment may be beneficial to participants, Adams said the lack of such features does not necessarily indicate either an error or problem with the plan itself. He noted that there are some exceptions to this as set forth in the SECURE 2.0 Act which apply to newer plans established after 2022 but not to older plans.

Abernathy conceded that not all of the risks identified in the firm’s report represent a legal infraction per se, but he said that some of the features that plans may lack, such as QDIAs, are easy to implement and can benefit plan participants. He said he is also concerned that employers may not be doing enough to ensure they are providing high-quality, low-cost investment funds to employees and beneficiaries, which could create future legal liabilities.

“We are not saying that every one of these things is a legal catastrophe,” Abernathy said, “but when you have red flags and have them for years and years and years, it’s just an indication that you’re not paying attention.”

HR executives encouraged to boost retirement education, find qualified help

Employers could do more to improve employee financial education, including increasing opportunities for one-on-one training, the Abernathy Daley report said. Abernathy told HR Dive that setting up a 30-minute meeting between an individual employee and an advisor once or twice per month to go over their investment questions and strategies can help workers better understand their options.

“Employees need to know how much they need to save for on-time retirement and how much to save from each paycheck,” he said. “A lot of them are not paying attention to this.”

Adams said he agreed that additional one-on-one time with employees would be helpful, particularly in times of market volatility. He added that employees should be cautious about the source of financial advice but that employer-sponsored plans can provide some assurance to those who need guidance.

“One of the nice things of doing that under the auspices of an employer-sponsored plan is that the fiduciary duty is applied by them by the hiring of that individual,” Adams said.

HR, meanwhile, often lacks the financial sophistication to ensure its benefits plans are delivering for plan members, Abernathy said. “That’s not a diss,” he added, “they just didn’t go to school for finance. They’re not steeped in the daily comings and goings of the financial service industry. It’s incredibly complicated, maybe purposefully.”

Because of the knowledge gap, HR should choose plan advisors who can create fund lineups that are the best in their class and meet with employees on a regular basis to help them understand the risks they are taking, Abernathy said. That employees might want more financial guidance from their employer is not a new idea; a 2023 survey by online savings platform Vestwell found that 9 in 10 employees said their employer should be involved in their retirement education.

HR teams tend to have a wide array of responsibilities in which retirement plans end up being “kind of a sliver,” Adams said, even if retirement is in actuality one of the most impactful things under HR’s purview. But losing track of retirement planning is particularly concerning if an HR professional is serving on their plan committee and has a personal liability for fiduciary breaches and wrongdoings, he added. If that’s the case, Adams said practitioners should consider pursuing personal liability insurance, if their employer does not already provide it.

“At a high level, they need to be aware of the responsibilities that they have,” Adams said of HR professionals. “Retirement is not their full-time job, and it’s complicated.”

Hiring qualified help is crucial to navigating retirement plan issues, Adams continued, and it is important to hire experts who can help HR fulfill its associated responsibilities. He also noted that a variety of education programs and credentialing programs exist to get professionals up to speed, such as the Plan Sponsor Council of America’s certified plan sponsor professional credential.