The overtime rule is here, and its challenges have been long documented.

After months of speculation, the Department of Labor officially set the new FLSA overtime exemption salary at $47,476 last week. The rule will force many employers to choose between raising the salary of certain employees above the threshold or reclassifying employees entirely and granting them overtime pay. There is no easy option between the two.

The rule – and what it will take to become compliant – may signal a new era in the employer landscape, said Jim O’Connell, compliance analyst at Ceridian.

“If you take the new rules together with emerging technologies, they can in many ways change the ways we work,” he added.

Employers adjusting to the rule will need to work carefully – one step at a time. We spoke to some experts in the field to discern what the most important issues are right now and what they’ll mean down the line.

The pay options: 5 key things

With the new rules come new considerations, made no less difficult by the fact that the rule will affect employers differently depending on their size. Tara Wolckenhauer, Division Vice President of Human Resources for ADP, recommends 5 strategies for all of their clients to follow. The list also serves as a good overview of what employers should do first.

- Take stock in and review employee classifications. An obvious but important first step, largely because many employers may not actually know the answers right away. Who will the new law impact based on pay alone and why?

- Closely manage and monitor employee hours. Do you actually know how many people in your populations are working over 40 hours per week? “Some can answer, some really do not know,” Wolckenhauer said. “They think exempt employees still work 9-5, but many of them work 70 hours per week.”

- Compare the cost of the pay options presented – raising an employee salary to reach the new level or reclassifying employees as nonexempt. Each one will bring new types of cost, and an employer must calculate for all of them, including the effect of benefits on compensation.

- Consider how any changes will look internally. Employees will talk. Concerns over why some people may be getting raises while others are not will likely bubble up. Be prepared with a communications plan.

- Consider how an employer will control their costs. What will make the new changes possible? Will associates need to be paid less to accommodate for overtime pay?

These recommendations are straightforward, but key – especially for employers who may not have been aware of a rule change prior to it actually occurring.

“What I worry about is awareness,” Wolckenhauer said. Recent ADP research backs up her concern. “75% of small and 50% of midsized businesses were not aware of the rule change...and not everyone has an HR department or is following legislation like that.”

But even for employers who were aware of the upcoming rule, its official implementation may force some to consider why their employees are working long hours each week. What can be done to improve the work experience? O’Connell called it “scheduling smarter, not longer.”

“How do you ensure that the nonexempt employee who is overtime eligible is working at the right times and at the most productive tasks?” he asked. Technology – and the way employers schedule their employees – will play an important role.

Scheduling: The growing influence of new tech

Employers do have a choice in how they reclassify and schedule their employees, O’Connell said, but there hasn’t been much discussion on the implications of such choices. Solving scheduling problems will require creative strategies that not only control overtime hours but also boost productivity.

Enter: new technology.

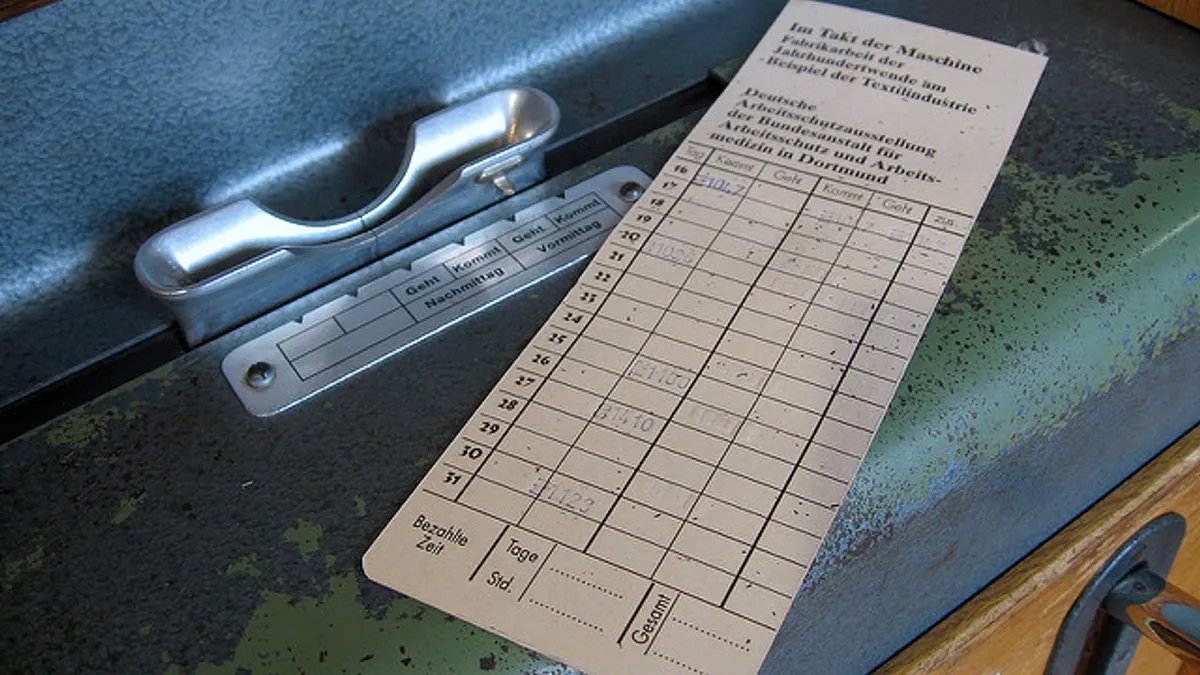

The way employers track hours on the job has transformed in a short time thanks to the cloud, which gives both employers and employees access to real-time data “in a way that can dynamically synchronize with workflows,” O’Connell said.

It’s the smaller companies or those who haven’t had to worry about time keeping that tend to have lax tracking mechanisms, Wolckenhauer said. Most large employers have chosen a vendor or time-tracking system that works for them, but even they may need to take a second look at the technology out in the field right now.

“The last time the overtime rules were modified in 2004, you didn’t have these technologies,” O'Connell added. “You put managers in a difficult position then.”

When both employers and employees have access to such technology and both can see the amount of hours worked, they can work together to create action plans and ensure productivity while capping hours at the appropriate level.

Luckily, most modern tech allows employees to access time-tracking tools wherever they are, stemming some concerns about the impact on telework – though not all of them. Tracking an employee every time they check their email at home would be arduous for both employee and employer.

“It’s a big concern,” O’Connell said. “Obviously it’s easier to have exempt employees working from home for flexibility. But these technologies will be able to bridge that gap.”

More importantly, this new overtime rule could be a window to the future of work, particularly as new technologies are implemented to ensure compliance and productivity. But such a transition cannot occur without the other holy pillar: communication.

Morale: Communication will be key

Rampant confusion and miscommunication throughout the workforce could lead to massive hits to employee morale if an employer doesn’t carefully plan their communication strategy.

Both O’Connell and Wolckenhauer emphasized the importance of being open and honest about what the rule change means. As has been documented, reclassifying some employees could lead them to believe they are valued less – especially if that will impact their benefits, like paid vacation.

O’Connell says to ensure employees understand that any changes are due to a federal government requirement, and that employers should try to explain why the federal government made this decision.

“According to the DOL and the president, the previous rules were out of date,” he added. “I think people would agree that the 2004 level is out of date.”

Any changes will require a 360 degree communication approach, Wolckenhauer said, including the written word and social media.

“Be sure they are communicating their employees’ value,” she added. Emphasize that this is no one’s fault and that a change in job classification does not mean a change in how that employee is valued. Remain open to answering questions as they appear in order to cut rumors off at the bud. Ensure teams are prepared to handle changes, too, particularly the payroll and legal teams.

Since 12 years have passed since the last rule edit, employers may not have much experience communicating “such a profound change,” O’Connell said. How information is communicated, be it one-on-one from direct supervisors or broad messages from the CHRO, will matter, especially with an issue as large as this.

Many say that this rule is one way that President Obama seeks to establish his legacy – by protecting workers and improving productivity. Since wage growth and productivity tend to go hand-in-hand, increasing one often helps the other.

Just before the rule was implemented, productivity had been declining, O’Connell said.

“This rule is trying to boost the wages of middle class workers and it has to somehow match up to productivity,” he said. But ultimately, each employer will have to work to find an individual solution to ensure productivity during this time of change.

Employers have until Dec. 1 to prepare their workforces.